“Whoa, wait a minute,” I can hear you protesting, “Dude, what are you saying? No way! That might apply to you, but definitely not to me. I am special!”

Face it, my friend, you’re nothing special, because the mediocrity principle simply states so.

The universe does not revolve around you; this planet is not privileged in any unique way; your existence is not the product of directed, intentional fate; and that smoked salmon sandwich you had for lunch was not plotting to give you indigestion.

The universe does not revolve around you; this planet is not privileged in any unique way; your existence is not the product of directed, intentional fate; and that smoked salmon sandwich you had for lunch was not plotting to give you indigestion.

Most of what happens in the world is just a consequence of natural, universal laws—laws that apply everywhere and to everything, with no special exemptions or amplifications for your benefit—given variety by the input of chance.

Everything that you, as a human being, consider cosmically important is, in fact, an accident.

The rules of inheritance and the nature of biology mean that when your parents had a baby, it was anatomically human and mostly fully functional physiologically, but the unique combination of traits that make you male or female, tall or short, brown-eyed or blue-eyed, was the result of a chance shuffle of genetic attributes during meiosis, a few random mutations, and the lucky outcome from the grand sperm race at fertilization.

We all like to think that we are special.

In one College Board survey of 829,000 high-school seniors, 0% rated themselves below average in the “ability to get along with others,” 60% rated themselves in the top 10 percent, and 25% rated themselves in the top 1 percent.

Compared with our average peer, most of us fancy ourselves as more intelligent, better-looking, less prejudiced, more ethical, healthier, and likely to live longer—a phenomenon recognized in Freud’s joke about the man who told his wife, “If one of us should die, I shall move to Paris.”

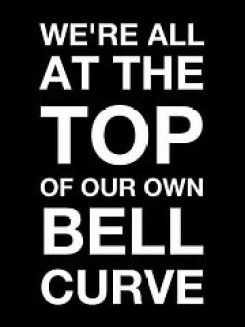

No one, it seems, believes that he or she is just part of the population contributing to the statistics generating averages. We do not believe that we are average, but we do believe that everyone else is.

This tendency, which springs from the self-serving bias, is called the illusory superiority effect.

In consequence, to evaluate ourselves is to lie to ourselves, especially when the evaluation requires us to compare ourselves to the average person. Because in each of us lurks a con man who is forever encouraging us to overestimate our abilities.

Additionally, the less skilled or experienced we are at something, the harder our inner con man would work at convincing us that we are brilliant at it. And that’s good, up to a point. By fibbing to ourselves, we can give a much-needed boost to our self-esteem.

Still, fibbing to yourself is one thing, but telling outrageous whoppers is quite another thing altogether (see also Dunning-Kruger Effect).

Stay Humble

Like in investing. A pinch of confidence encourages you to take sensible risks and keeps you from storing all your money in the asset class of “shriveling cash” – aka Fixed Deposits – offered by those generous banks. But if you think that you’re Warren Buffet or Peter Lynch, your inner con man isn’t just telling little fibs; he’s a big fat liar.

Because you would never make the most of your investment potential if you think you have far more potential than you actually do. The only way to achieve everything you’re capable of is by accepting what you are not capable of.

Therefore, stop listening to your inner con man who—what a surprise—never has anything bad to say and accept the evidence that you are most probably not better than average. And then remind yourself often that half the people you know are below average.

But, to return to the “money theme”, do take note that the single greatest challenge you would face as an investor is accepting the truth about yourself because investing isn’t you versus “Them”, it’s you versus you.

So, stay humble.

By the way, even an average hit rate of around 50% in your trades can make you big money. It is all about what you do with your position once you have entered into it!

“Each of us is ordinary, yet one of a kind.” — Samuel Barondes

“There are a lot of cognitive ills that would be neatly wrapped up and easily disposed of if only everyone understood this one simple idea of mediocrity.” — P.Z. Myers

It is tempting to fool yourself: “The greatest sign of an ill-regulated mind is to believe things because you wish them to be so.” — Sherlock Holmes

Yup, most of us statistically speaking will be average. Heck looking at the performance of some of the CEOs and political leaders, many seem to be even below average! Haha!

That’s why in personal finance & investing it is much more important to acknowledge that you don’t really know, and learning how to manage risks and errors.

Empirical academic interviews & studies also showed that those with proven above average performance tend to consistently rate themselves *below average*. While those actual below average performers consistently rated themselves highly!! Heheh!

Hi Sinkie, you might be right with those CEOs and political leaders being below average. The problem is that they usually score above average in terms of overconfidence. A bit more humbleness might be helpful.

Yeah, awareness of the fact that we don’t really know that much is a healthy start. To close that knowledge gap it helped me to strive to know myself better. Because in investing it is not me against them, but me against myself and my emotions. And to know oneself it is irrelevant to know whether one is below or above average. By spending efforts in getting to know oneself we make us automatically “above average” as not too many people bother to put that effort in.